Table of Content

Their expert loan consultants will then assist you in making the best decision for your financial situation. One place where loanDepot truly shines is with its vast network of loan officers. They have over 1,700 licensed loan officers across the country, so you can talk to someone in your state and possibly even in your city. Bankrate’s editorial team writes on behalf of YOU – the reader.

Customers can easily track their application with the lender and can get in touch with an advisor whenever they need to. Funds are usually made available to applicants two or three days after approval and are delivered in a lump sum payment. LoanDepot’s status as one of the first online lenders means it is at the forefront of using technology in finance. It has kept this up over the years, and has an easy to use system that keeps a human touch with phone contact options.

Is loanDepot a reputable lender?

Also known as a second mortgage, LoanDepot’s home equity loan allows you to get access to up to 90% loan-to-value of the equity in your home. For example, if you have $50,000 in equity, you can borrow up to $45,000 from the lender. The problem is that many traditional home equity loans take weeks to get approval and funding. So, if you’re in a hurry, using a lender like LoanDepot can speed up the process. LoanDepot Home Equity Loans may charge a loan origination fee of 1% to 5% of the loan amount. Remember the APRs of home equity loans do not include points and financing charges, just the interest rate.

Due to this extra amount, it’s popular with borrowers who buy old homes they intend to renovate. Another essential part of the mortgage lending experience is its level of customer service and timely response to complaints. For a better picture of the lender’s customer satisfaction level, we examine reviews from customer research organizations. The three agencies we refer to in this criterion are the Better Business Bureau, J.D. Power, and the Consumer Financial Protection Bureau.

You’re our first priority.Every time.

You can also opt for an FHA ARM when buying or refinancing a home. LoanDepot operates in all 50 states as well as Washington, D.C. Unfortunately, it doesn’t publish its interest rates online—to see your rates, you’ll have to fill out an application. LoanDepot earns 4 of 5 stars for average mortgage interest rates. Working directly with a loan officer makes it possible to get quick answers to your questions throughout the process. We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

Its expedited application is powered by AI to verify asset and employment details, perform credit checks and begin the home appraisal process. There is a need to prove equity in the home as well as have a solid credit score and the income to repay the loan. While the approval process is generally faster than with a purchase or refinance first mortgage, the same type of paperwork and documentation is required. The guidelines for home equity mortgages are a little more restrictive in general.

Traditional adjustable-rate mortgage

This gives you the opportunity to choose different loan terms, if you’d like. However, if you are content with the terms of your current first mortgage, a home equity loan can be an ideal option. For any questions regarding a home equity loan, speak to a loanDepot licensed loan officer today. Adjustable-rate mortgages are also available through loanDepot with three-, five-, seven- or 10-year terms.

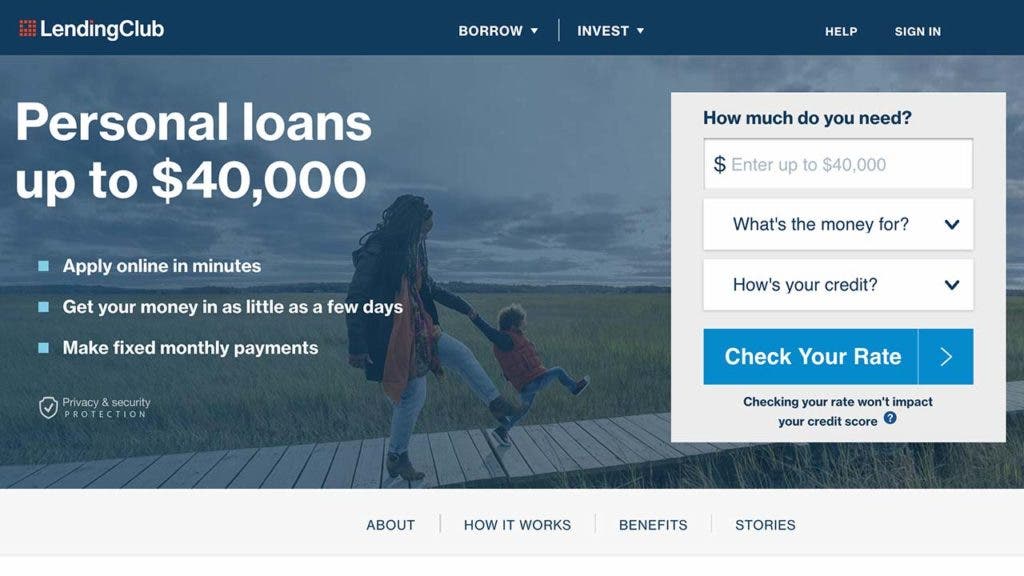

It's at +100 if everybody recommends the provider, and at -100 when no one recommends. Fill in one form at LendingTree and let all the best home equity loan companies tell you what they are willing to offer. Providers, LoanDepot has funded over $165 billion of loans over the last decade. Only when you feel that you are satisfied with the terms and conditions laid out in your loan agreement should you sign the loan agreement.

LoanDepot overview

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Another perk that LoanDepot offers its borrowers is a lifetime guarantee of free lender fees.

LoanDepot, Inc engages in originating, financing, selling, and servicing residential mortgage loans in the United States. It offers conventional agency-conforming and prime jumbo, federal assistance residential mortgage, and home equity loans. For its jumbo loans, it claims to have closings up to 50% faster than the industry average. FHA loans are one of its more popular loan products that cater to customers with low credit scores and high debt-to-income ratios. Borrowers who usually have a hard time getting approved for a loan because of these factors may have a chance of getting approved with loanDepot.

This can help you figure out where you might qualify as well as lock in a favorable rate. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive.

While Capital One has limited options if you are looking for a home equity loan, it does have alternatives you might want to consider for your borrowing needs. In 2021, loanDepot took in close to 127,000 home purchase applications and closed on 75%. You should be ready to provide information relating to your income and assets; loanDepot uses information to calculate how much you can borrow. Great Mortgage company, they have great follow up, do what they say.

Those looking for home refinancing may also find assistance with loanDepot’s cash-out and rate and term refinancing services. Even the best mortgage refinance companies have limitations. LoanDepot can offer slightly more competitive rates only because its loans are always the first-position lien on the properties used to collateralize their loans. If you’d like to know if now is a good time to refinance your mortgage, it’s a good idea to crunch the numbers and see if it makes sense for your current financial circumstances.

No comments:

Post a Comment